|

Here is a practical guide to help you get the right tax on bonuses (& other lump sum payments to staff) Types of payments covered Lump sum payments include:

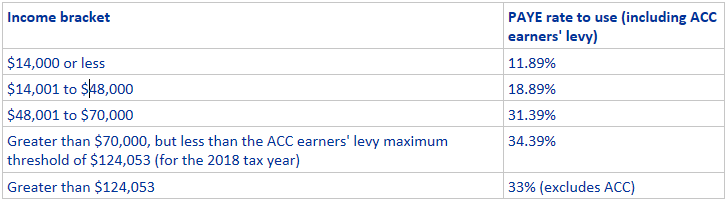

Overtime or any regular payments are not considered lump sum payments. Calculating PAYE on lump sums Follow these steps to work out the PAYE rate to use for a lump sum payment:

Choose the right PAYE rateYou can use the PAYE rate of 34.39 cents in the dollar if the employee asks you to. Other deductions to makeThere may be student loan repayments, KiwiSaver and employer contributions on bonuses and lump sum payments/ACC earners' levy should only be applied to earnings below the threshold of $124,053. Being "unearned" income, ACC levy is not applied on the following payments:

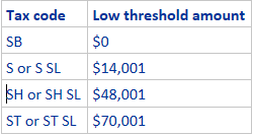

In these cases the PAYE rates will have to be reduced by 1.39%. Redundancy payments and retiring allowances are exempt from KiwiSaver employee deductions and employer contributions. Secondary tax and lump sumsSecondary tax codes are used by people with more than one source of income, eg for a second job, or for a part-time job if they also receive an income-tested benefit. If the employee uses a secondary tax code:

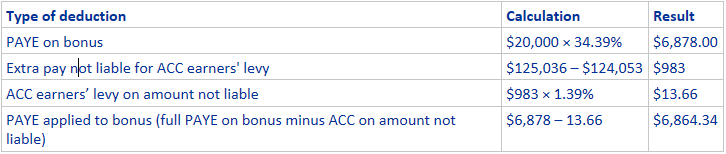

Secondary tax exampleJohn has a second job and uses the ST tax code. His secondary employer wants to pay him a one-off bonus of $20,000. John has earned $2,695 from his second job in the last 4 weeks. Following steps one to five, John's employer can work out the amount of PAYE on his $20,000 bonus: John's employer continues working out the PAYE like this: Gross Or net bonuses?The above situation makes it complicated to when net bonuses are declared by employers. We'd have to run through models to get to the gross amount. In the end, it oftens becomes complicated for employees to understand the complexities of calculation and further management time as to be applied for them to get clarity. We recommend that managers ALWAYS declare GROSS bonuses rather than NET bonuses. Disclaimer

The above publication discusses income tax & other issues generally and is not intended to be specific tax or other advice. Whilst every effort has been made to provide valuable, useful information, Core Business Services Ltd, any related suppliers, associated companies & practices accept no responsibility or any form of liability from reliance upon or the use of its contents. Any suggestions should be considered carefully within your own particular circumstances, as they are intended as general information only. Please do consult with your tax advisor or call this firm for information / advise specific to your circumstances before finalising any particular course of action

0 Comments

Leave a Reply. |

AuthorCORE Business Services Archives

September 2021

Categories |

RSS Feed

RSS Feed