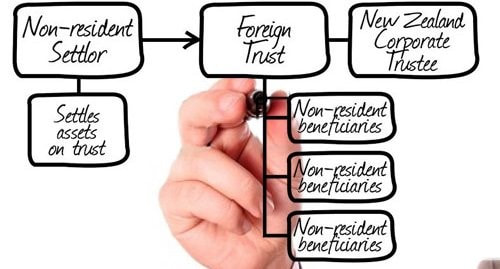

What the different types of Trusts for Tax purposes?There are three types of trust for New Zealand income tax purposes:

This article only deals with Foreign Trusts.

0 Comments

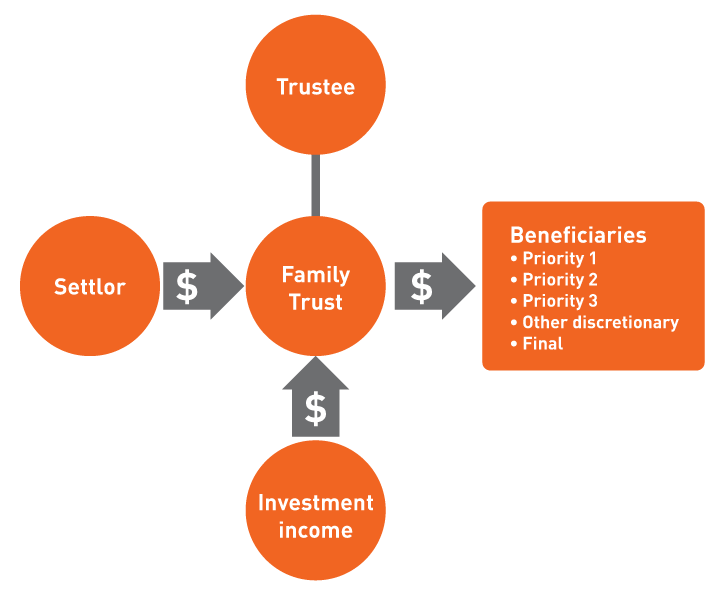

What is a family trust?A trust exists when one person (a "trustee") holds and owns property for the benefit of another person (a "beneficiary"). A family trust is a trust set up to benefit members of your family.

The purpose of the family trust is to hold (through you transferring your assets), so that legally you own no assets yourself, and through the trust, still have some control over, and get the benefit of, these assets. You can set up a family trust either while you are still alive (by a declaration of trust contained in a trust deed) or when you die (by the terms of your will). This article is mainly concerned with trusts created while you are alive, and with the benefits that these trusts can provide for you in your lifetime. The family trust can be setup either as a "Fixed" trust (with named / specified beneficiaries with fixed ratio / amount of benefits) or a "Discretionary" trust (with "described" beneficiaries with benefits that are at the "discretion" of trustees). This is discussed in a bit more detail in the beneficiaries section below. BackgroundMore and more companies are being re-organised by value chain (how the business adds value to its customers and stakeholders) rather than functionally (Products, production, finance, HR etc). Unfortunately management accounting has failed to keep pace in delivering value added proactive periodic financial reports!

This is particularly true in small to medium sized organisation (both for and not-for-profit sectors) where traditional accounting is used mostly as part of its compliance infrastructure. Among other disadvantages, this approach

Incorporating the portfolio approach to management reporting insures that

Although the concepts, in different incarnations, are applicable to both new and existing businesses, it is particularly beneficial to those at the cusp of a growth spurt. BackgroundIn October 2015, the National Government introduced the Bright Line Test on land transactions. This was an attempt to slow down the runaway property market by imposing extra "costs" on land transactions that fall within the ambit of the Bright Line Test!

The government didn't really have a choice - the dreaded Capital Gains Tax is political suicide and the runaway property prices was hurting the government's chance for re-election (oh yes! & the public). So, quite brilliantly, they applied what is common in some European countries. It is obviously working as CoreLogic data shows that 7% of the Auckland sales in 2016 were properties that were sold within a year compared to 11.7% at the peak of the last boob during mid-2000. |

AuthorCORE Business Services Archives

September 2021

Categories |

RSS Feed

RSS Feed