|

With Labour, NZ First & Greens coalition government, New Zealand's employment law is about to receive a shakeup!

Its never easy to balance to rights and obligations of employers and employees (& contractors) but eventually, it all ends up on the cost of the product or service the end-user buys. Gone indeed are the days when the end-user is forced to pay the said price. With opening of trade, too high a cost of production and distribution, makes the product or service uncompetitive relative to imports and too low a price, makes it uneconomical to produce relative to other investment opportunities. It is likely we will see a mixture of the below proposals implemented in the coming years. Employers will need to be alert to these proposed policies and be ready for change and we will be there to assist as needed. To give you a flavour of what may transpire, we list below the campaign promises made by the above three parties. The information has been collated from individual party websites and articles written by employment law specialists.

0 Comments

Suppose that every day, ten men go out for lunch and the bill for all ten comes to $100. If they paid their bill the way we pay our taxes (including GST on purchases), it would go something like this:

So, that's what they decided to do. The ten men ate lunch in the restaurant every day and seemed quite happy with the arrangement, until one day, the owner threw them a curve ball. "Since you are all such good customers," he said, "I'm going to reduce the cost of your daily lunch by $20.00." So lunch for the ten men would now cost just $80. The group still wanted to pay their bill the way we pay our taxes. So the first four men were unaffected. They would still eat for free. But what about the other six men? How could they divide the $20 windfall so that everyone would get his fair share? They realized that $20 divided by six is $3.33. But if they subtracted that from everybody's share, then the fifth man and the sixth man would each end up being paid to eat his lunch. So the bar owner suggested that it would be fair to reduce each man's bill by a higher percentage the poorer he was, to follow the principle of the tax system they had been using, and he proceeded to work out the amounts he suggested that each should now pay.

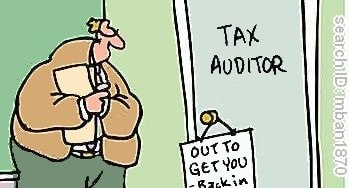

Each of the six was better off than before. And the first four continued to eat lunch for free. But, once outside the bar, the men began to compare the amount they got off. The sixth man said, "I only got $1 off out of the $20 while the tenth man got $10 off!" "Yeah, that's right," exclaimed the fifth man. "I only got $1 off, too. It's unfair that he got ten times more benefit than me!" "That's true!" shouted the seventh man. "Why should he get $10 off, when I got only $2? The wealthy get all the breaks!" "Wait a minute," yelled the first four men in unison, "we didn't get anything at all. This new tax system exploits the poor!" The nine men surrounded the tenth and told him they were angry that he got so much off while they each got very little. The next day the tenth man didn't show up for lunch, so the nine sat down and had their lunches without him. But when it came time to pay the bill, they discovered something important. They didn't have enough money amongst all of them for even half of the bill! And that is how our tax system works. The people who already pay the highest taxes should naturally get the largest benefit from a tax reduction. Tax them too much, attack them for being wealthy, and they just may not show up anymore. In fact, they might start eating overseas (& there are a million and one instruments to avoid taxes), where the atmosphere is somewhat different (there is no such thing as a fair tax system)! Socialist ideals only works to provide for the bottom rung of Maslow's hierarchy of needs! Anything above that, everybody suffers making everybody poorer!...and most importantly kill innovation! examples abound from Cuba to China so unless you want be that, you've got to think harder about what you want! For those who understand, no explanation is needed. For those who do not understand, no explanation is possible. ~Sourced from the LSE think tanks

|

AuthorCORE Business Services Archives

September 2021

Categories |

RSS Feed

RSS Feed